Investments and UK Tax

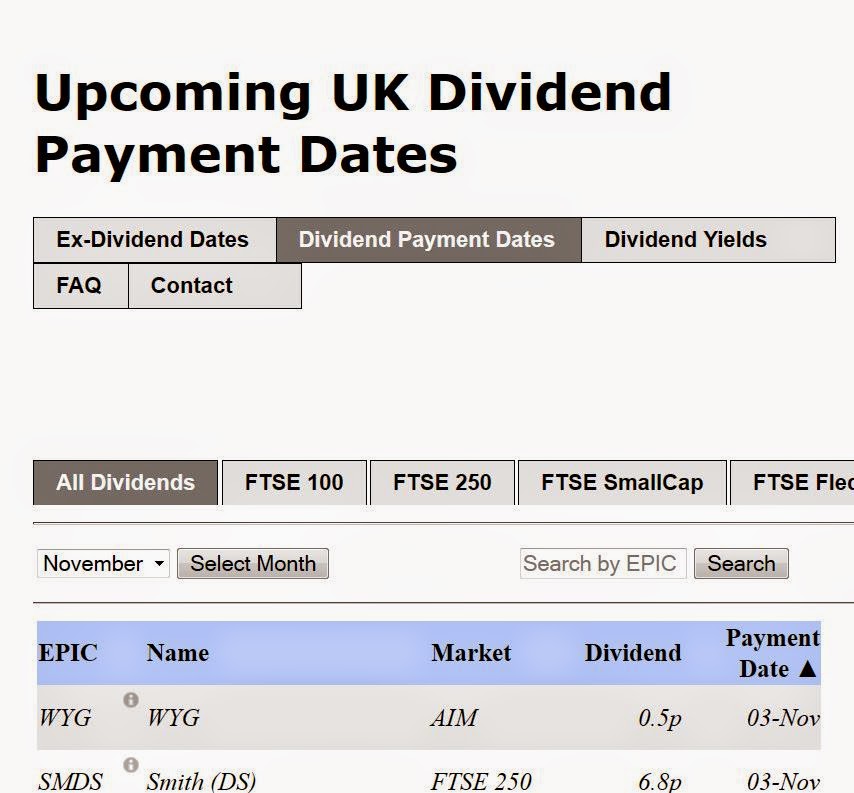

Note: Please be aware that this article was written in 2014. It's best to check the latest tax rates and rules on the .gov.uk website as rules do change every year. The uswitch website has a very nice summary on tax and investments. You can view the original web page here . Chances are that you are affected by tax from investments if you have at least one of the following (although this is by no means a complete list): 1. Interest from savings . 2. Income from a pension. 3. Rental income. 4. Dividends from shares. 5. Capital gain from the sale of shares or property. An exception to these tax rules is dividends or gains within an ISA, which are tax-free. Interest from savings will have basic rate tax taken off at source (20% tax deducted at source), so you don't need to pay any additional tax unless you pay a higher rate income tax. For other income and capital gains, you will need to declare them by filing a Personal Tax Return every year. 2024 Update: I...